Income from RM2000001. Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85 info tax exemptions malaysia 2019.

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Resident Individual Tax Rates for Assessment Year 2018-2019.

. Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. On the first 5000 Next 15000. Read on to learn about your income tax rate and filing your 2018 personal income tax with LHDN.

Malaysia Residents Income Tax Tables in 2019. On the first 35000 Next 15000. Removed YA2017 tax comparison.

23 rows Tax Relief Year 2018. Corporate tax rates for companies resident in Malaysia is 24. Income Tax Rate Table 2018 Malaysia.

The Resident Tax Relief for Working Expatriates in Malaysia for Year Assessment 2018 is as follows. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment.

In the sixth year and thereafter. In the fourth year. This would enable you to drop down a tax bracket lower your tax rate to 3per cent and reduce the amount of taxes you are required to pay from RM1640 to RM585.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. The benchmark we use refers to the Top Marginal Tax Rate for individuals. Malaysian Income Tax Rate 2018 Table.

Income from RM3500001. On the First 5000 Next 5000. Tax Rate Table 2018 Malaysia.

Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates taxplanning budget 2018 wish list the edge markets. The amount of tax relief 2018 is determined according to governments graduated scale. On the first 50000 Next.

EPF Rate variation introduced. Chargeable Income Calculations RM Rate TaxRM 0 - 5000. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Malaysia Personal Income Tax Guide 2018 YA 2017 Calculating personal income tax in Malaysia does not need to be a hassle especially if its done right. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. In the third year.

8 EPF contribution removed. YA 2017 Rate YA 2018 Rate YA 2017 Tax RM YA 2018 Tax RM 0-5000. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

Employment Insurance Scheme EIS deduction added. Rate 112010 - 31122011. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

Income from RM500001. Malaysian Income Tax Rate 2018. Thats a difference of RM1055 in taxes.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. In the fifth year. The maximum rate was 30 and minimum was 25.

Rate TaxRM 0 - 2500. The Personal Income Tax Rate in Malaysia stands at 30 percent. Resetting number of children to 0 upon changing.

Whats people lookup in this blog. Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00 Allowance Bonus0000. On the first 2500.

On the First 35000 Next 15000. In Malaysia the Personal Income Tax Rate is a tax collected from individuals and is imposed on different sources of income like labour pensions interest and dividends. On the First 50000 Next 20000.

EIS is not included in tax relief. The system is thus based on the taxpayers ability to pay. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

Personal Income Tax Rate in Malaysia remained unchanged at 30 in 2021. Data published Yearly by Inland Revenue Board. 5 5 5 0.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Whats people lookup in this blog. Malaysia Personal Income Tax Rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a max of 28.

On the first 20000 Next 15000. The latest Personal Tax Rate for the resident is as follows. Income from RM5000001.

Things That Might Seem Tax Deductible but Actually Are Not. Income attributable to a Labuan business. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Inland Revenue Board of Malaysia. The tax rebates below are applicable to expatriates who is a resident status and have stayed more than 182 days in Malaysia in a calendar year. On the First 2500.

Corporate Income Tax. On the First 20000 Next 15000. Income Tax Rate Table 2018 Malaysia.

13 rows 237450. Personal income tax in Malaysia is charged at a progressive rate between 0 28. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the.

Income tax rates 2022 Malaysia. On the First 10000 Next 10000. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will.

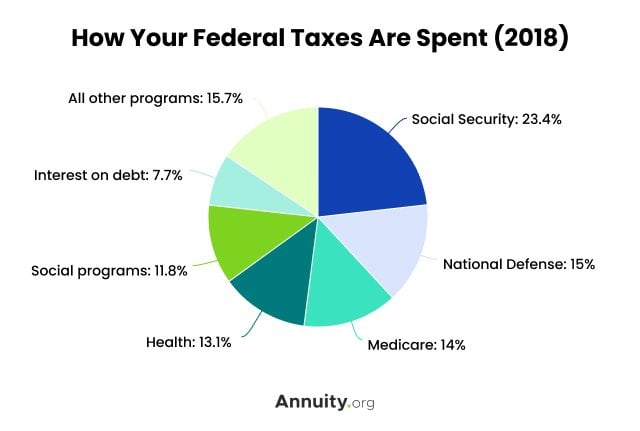

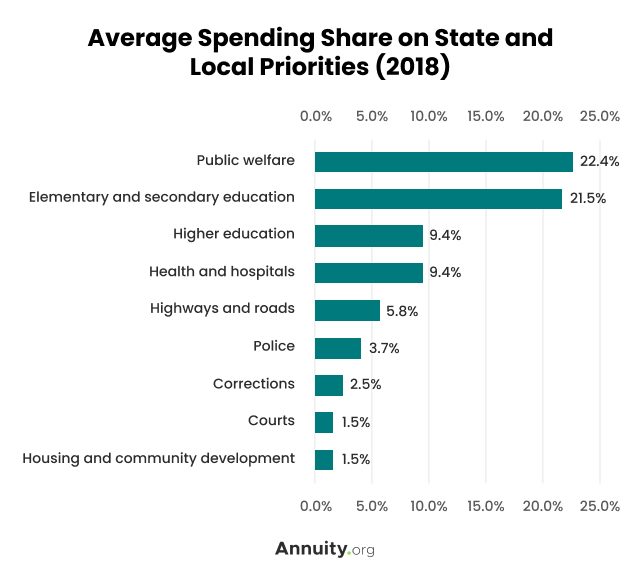

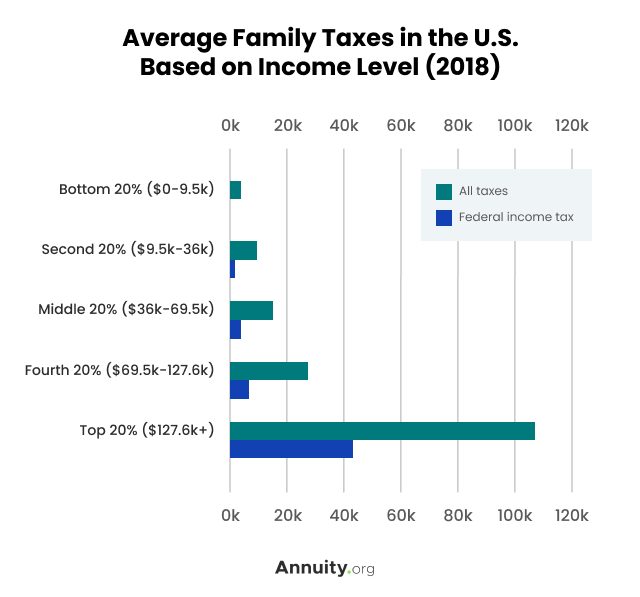

Tax Information What Are Taxes How Are They Used

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Tax Information What Are Taxes How Are They Used

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

U S Estate Tax For Canadians Manulife Investment Management

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Tax Information What Are Taxes How Are They Used

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

Eximius Is The Bookkeeping And Accounting Outsourcing Specialist Aiming At Supporting Your Busines Bookkeeping Bookkeeping And Accounting Cloud Accounting

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Tonga Sales Tax Rate 2022 Data 2023 Forecast 2014 2021 Historical Chart News

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

3d Model Of Bentley Continental Gt 2021 Bentley Continental Gt Bentley Continental Bentley

Why It Matters In Paying Taxes Doing Business World Bank Group

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets